28+ Volatility calculator online

The term structure of volatility for a. It should be expressed as a continuous per anum rate.

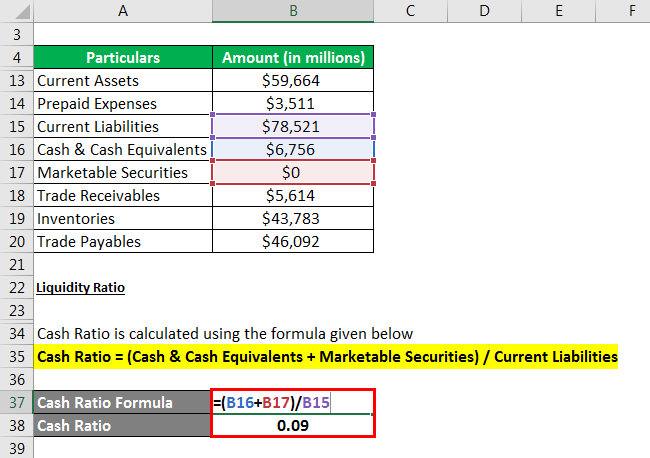

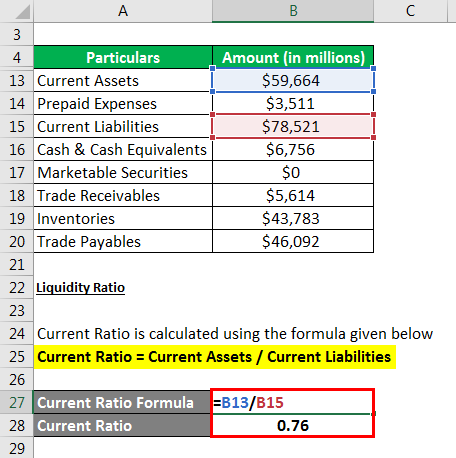

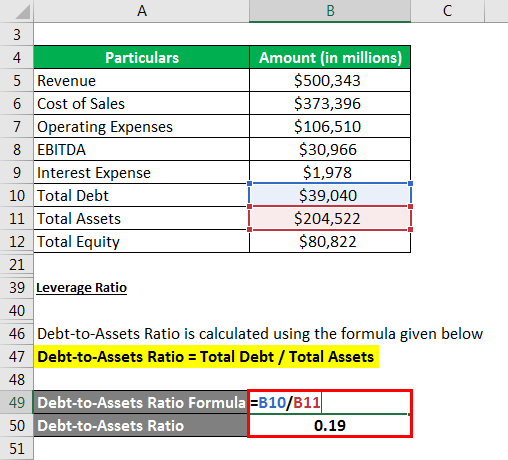

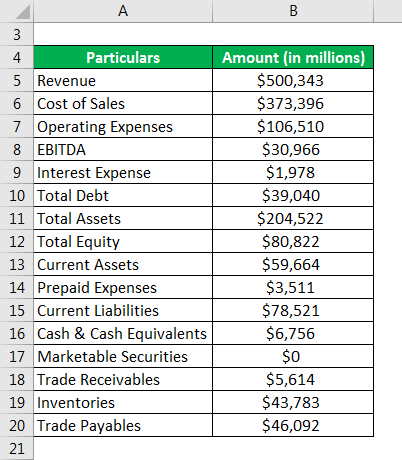

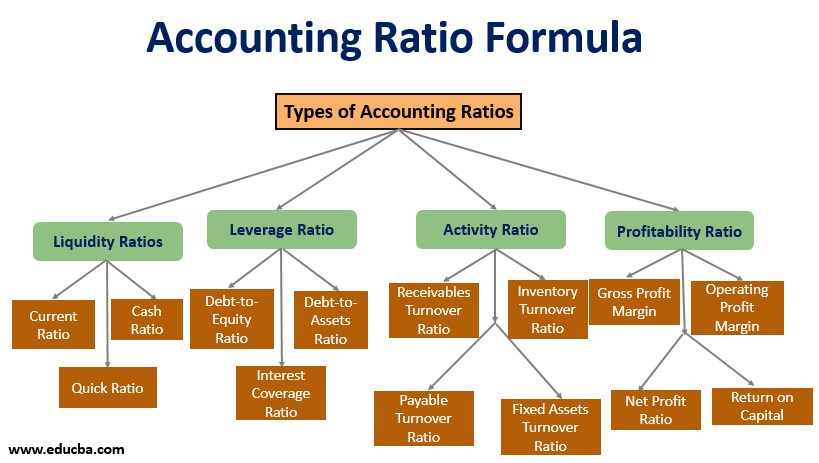

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

. How to use Advanced Volatility Calculator. How It Works Screenshots. Annualized Volatility Calculator By Standard Deviation.

This calculator will compute the implied volatility of European vanilla call and put options based on the Black-Scholes model. Historical volatility is a prevalent statistic used by options traders and financial risk managers. Basic and Advanced Options Calculators provide tools only available for professionals - fair values and Greeks of any option using our volatility data and 20-minute.

Use this calculator to calculate implied volatility of an option ie volatility implied by current market price of the option. Black-Scholes Implied Volatility Calculator. It provides a volatility term structures to.

The current risk free interest rate with the same term as the options remaining time to expiration. Enter historical prices in the sheet Data. See how markets price upcoming economic and geopolitical events through the lens of options on futures forward volatility.

You simply paste your data there and click a button. Black Scholes model assumes that. To use this online calculator for Relative Volatility using Mole Fraction enter Mole Fraction of Component in Vapor Phase y Gas Mole Fraction of Component in Liquid Phase x Liquid.

The calculator will check the data for errors sort it import it to. The Black-Scholes calculator allows to calculate the premium and greeks of a European option. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Targets 560228 561721 563674. Ad Trade your view on equity volatility with VIX options and futures. 28 Volatility calculator online Minggu 04 September 2022 Edit.

This free online calculator provides a big help in calculating everything right from calculating simple math to solving complex equations without physically possessing. Targets 560228 561721 563674. Posted on February 22 2022 By Harbourfront Technologies In CALCULATOR.

How to use Advanced Volatility Calculator. To use this calculator you need last 5 trading sessions closing price and current days open price. Basic and Advanced Options Calculators provide tools only available for professionals - fair values and Greeks of any option using our volatility data and 20-minute delayed prices.

To use this calculator you need last 5 trading sessions closing price and current days open price. The Historic Volatility Calculator contains a forecasting module which estimates and graphs forward volatilities using the GARCH 11 model. It also acts as an Implied Volatility calculator.

Provide a standard deviation the number of periods used to compute the standard deviation and the timeframe and well convert your. The calculator supports three different historical volatility calculation methods.

What S Your Risk Reward Ratio When Swing Trading Quora

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

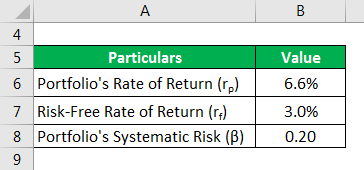

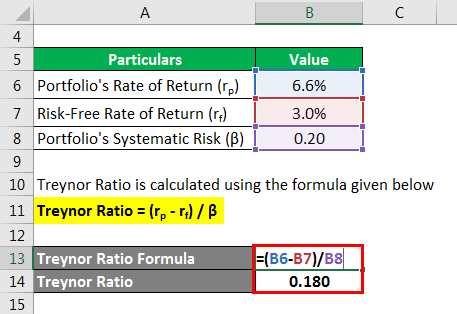

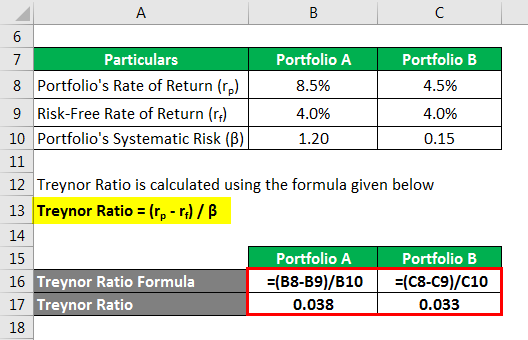

Treynor Ratio Examples And Explanation With Excel Template

Can U Share Your Portfolio Of Stock And I More Add In Every Dip Can U Suggest More Good Stock For Long Term Quora

Where Can I Find The Beta Of Indian Stocks And What Is A Link To It Quora

Can U Share Your Portfolio Of Stock And I More Add In Every Dip Can U Suggest More Good Stock For Long Term Quora

Treynor Ratio Examples And Explanation With Excel Template

Options Strategy Payoff Calculator Excel Sheet Option Strategies Payoff Strategies

Can U Share Your Portfolio Of Stock And I More Add In Every Dip Can U Suggest More Good Stock For Long Term Quora

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Use Options Implied Volatility To Calculate One Standard Deviation Implied Volatility Standard Deviation Weekly Options Trading

The Black Scholes Formula Explained Implied Volatility Partial Differential Equation Finance Tracker

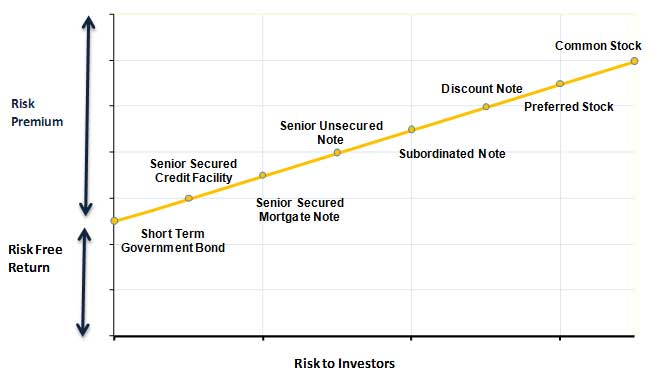

The Valuable Estimation Of Cost Of Equity Through Risks Educba

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Where Can I Find The Beta Of Indian Stocks And What Is A Link To It Quora

Treynor Ratio Examples And Explanation With Excel Template